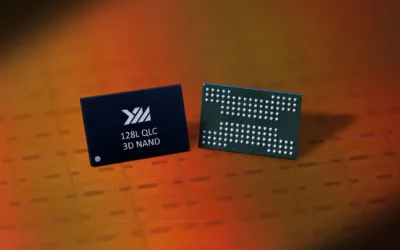

In tandem with a prelude of entry and competition in DRAM between the NAND flash giant, YMTC, and China’s top tier in DRAM field, CXMT, plans for YMTC DRAM HBM have come to the surface. According to reports, the partnership between YMTC in DRAM HBM is for hybrid bonding and HBM technologies, which cover not only the next-gen HBM3 but also beyond HBM. Such a collaboration could meaningfully expedite China’s ambitions for semiconductor independence while increasing competitive pressure on firms such as Samsung and SK Hynix on the global stage.

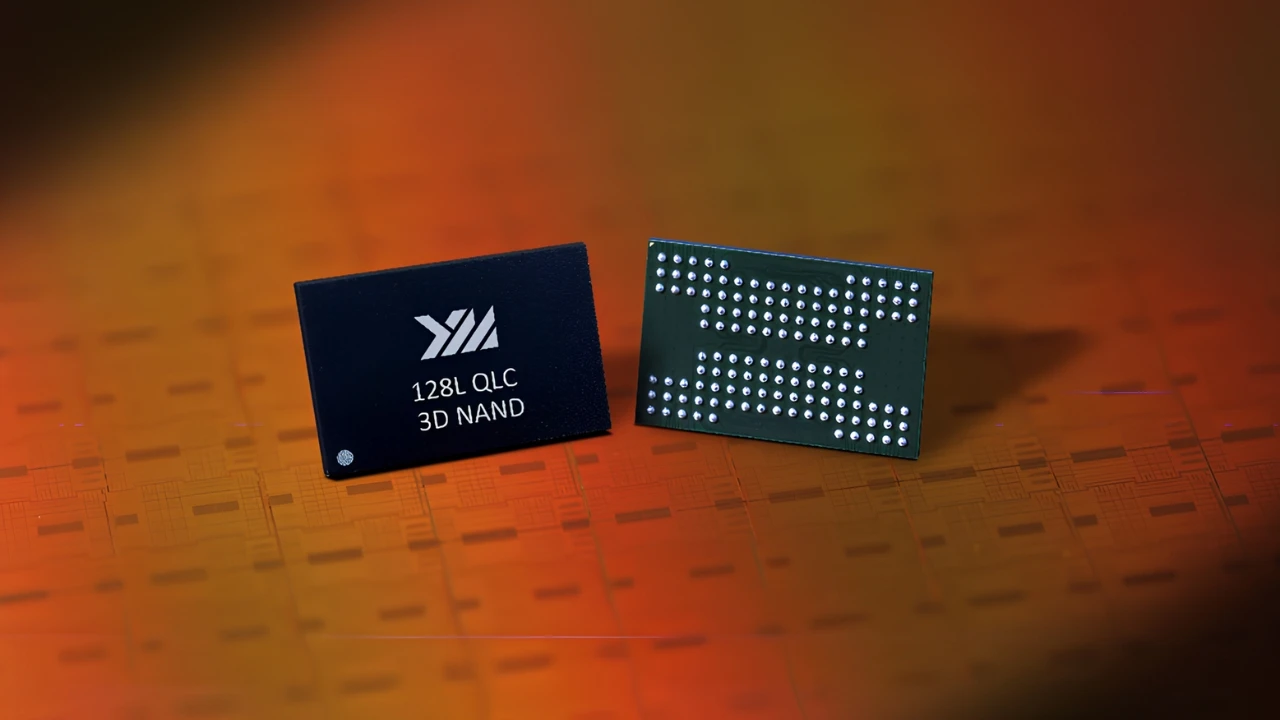

Why YMTC Is Entering DRAM

While YMTC has been an important NAND maker for years, US export controls forced the company to branch out. Pooling its NAND experience with DRAM expertise, the YMTC DRAM HBM project mixes together with CXMT. According to industry sources, YMTC has begun purchasing DRAM R&D equipment indicating solid commitment towards HBM Solutions.

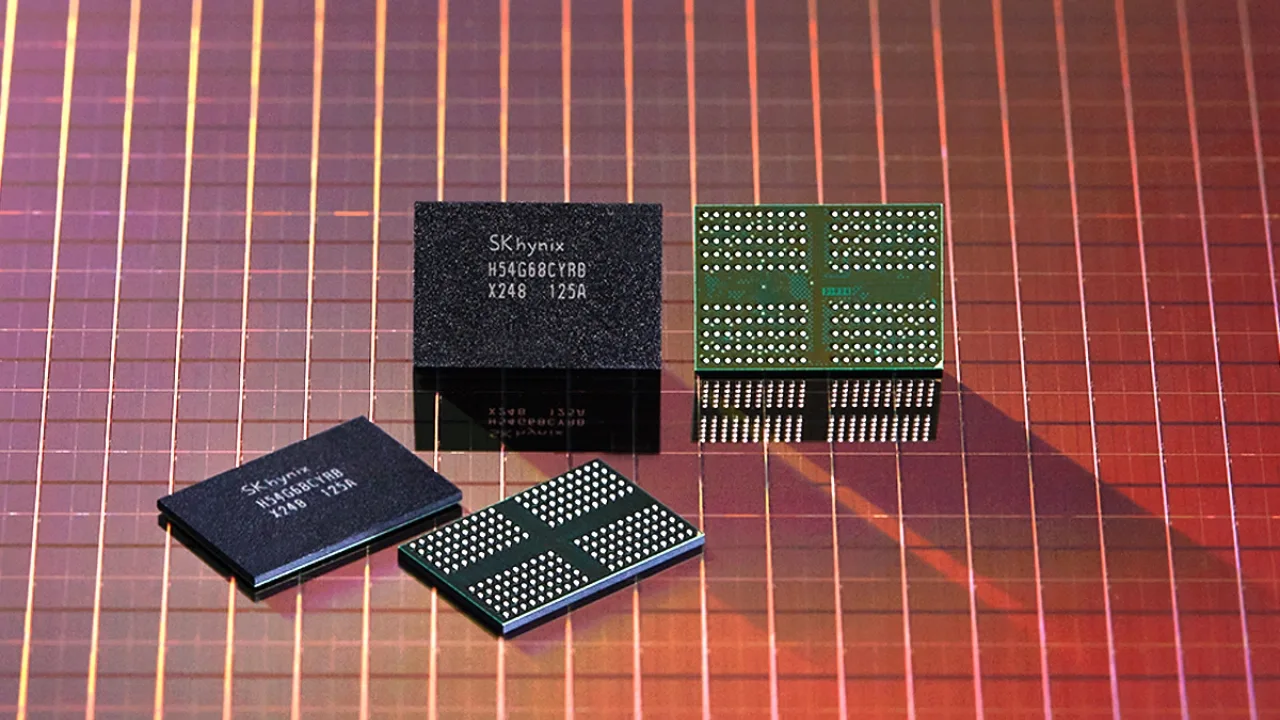

CXMT’s Role in HBM Production

CXMT, the most prominent DRAM IDMC in China, started mass production of HBM2. In case of YMTC DRAM HBM cooperation, CXMT contributes with hybrid bonding experience to promote HBM development efficiency. Specifically, the firm is said to be moving ahead test production of HBM3, and its partnership with YMTC is being interpreted as a way for the company to boost capacity and market scale.

Move to HBM3 and Beyond

The YMTC DRAM HBM roadmap is aggressive and goes straight for HBM3 and beyond. At the heart of this effort is hybrid bonding tech, which could also enable greater density and faster speeds. Since HBM is key to AI and high-end computing, YMTC and CXMT working together might cover a HBM production gap for China’s home-brewed AI stack.

Competitive Pressure on Korea

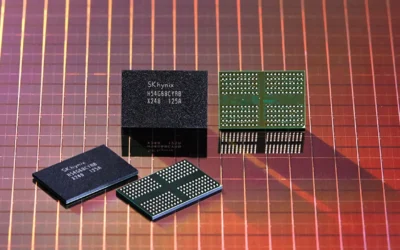

Currently, Samsung and SK Hynix are holding the worldwide HBM production. That said, now, with the potential emergence of a new Chinese challenger in the form of the YMTC DRAM HBM partnership, Korean firms still lead in technology maturity and IP, but rapid advances by YMTC and CXMT could bias the competitive landscape.

Strategic Importance for China

China’s partnership with YMTC for DRAM HBM is another example of this strategy, and exemplifies China’s plans to become a more self-sufficient, complete supply chain for semiconductors. Use of domestic HBM supply is considered necessary as AI adoption accelerates. This national priority is embodied in the YMTC DRAM HBM project, which seeks to gain memory resources without foreign dependence.

Market Impact

If everything goes according to plan, the YMTC DRAM HBM products may eventually show up in the domestic AI servers, GPUs, and supercomputers. Even outside of China, global customers will see YMTC DRAM HBM proposals as more of an option — particularly if the supply-side crunch in HBM continues.

Final Thoughts

In July 2023, the partnership between YMTC, CXMT, and DRAM HBM will be a milestone for the Chinese semiconductor journey. NAND knowhow with a penchant for DRAM means that the pair are leading the way to HBM3 and are looking like some proper competition for the high-bandwidth memory crown. We will see if YMTC DRAM HBM ambitions can actually challenge the likes of Samsung and SK Hynix in the years ahead.

FAQ

Partnership between YMTC and CXMT for DRAM & HBM Development (HBM3 with Hybrid Bond)

US Restrictions have led to a diversification of YMTC beyond NAND and YMTC is hopeful to support China self-reliant semiconductor strategy with YMTC DRAM HBM production.

CXMT adds years of DRAM manufacturing experience and hybrid bonding technology to enable HBM3 as things start to ramp.

Though Korean firms are still winnowing the technology, increased progress on YMTC DRAM HBM would allow a more competitive global HBM environment.

HBM is relevant for AI, HPC and advanced computing. All of this suggests that the domestic supply for the growing AI ecosystem in China would be ensured with something similar to the YMTC DRAM HBM.